Third Quarter Market Review and Commentary

Fed Focused on Lowering Inflation

Global markets declined in the third quarter as inflation remained high, geopolitical tensions escalated, and the Federal Reserve continued to hike interest rates.

The Federal Reserve’s main priority right now is to bring down inflation, which is running near its highest levels since the early 1980s.

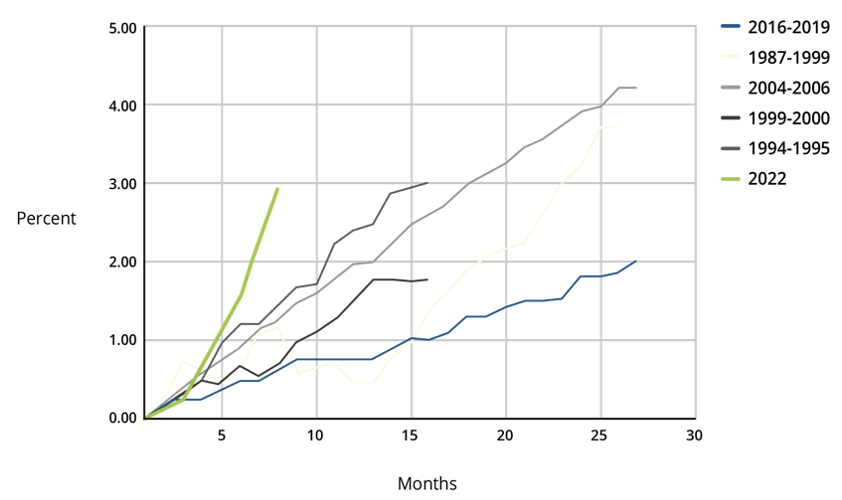

At the latest meeting in September, the Fed raised the benchmark interest rate 75 basis points to 3.25% and signaled the intention to further hike until it reaches the terminal rate of 4.6% sometime in 2023. The Fed is hoping that raising borrowing costs will lead to lower demand for goods and services which will ultimately put downward pressure on prices. Notably, rates have risen at a faster rate than any time in recent history, which has intensified the market selloff. The effect of the higher interest rate environment has been a reduction in the value of financial assets. The values of both stocks and bonds are determined by the future cash flows that they produce. These cash flows become less valuable when discounted at higher rates. In addition to the rapid rise in rates, there is a growing fear in the markets that our economy is headed towards a recession, which would lead to lower corporate earnings.

Change in the federal funds rate during the past six tightening cycles.

Source: FederalReserve.gov, 2022

Through the end of September 2022, the S&P 500 had one of its worst performance starts in its history, falling nearly 25%.

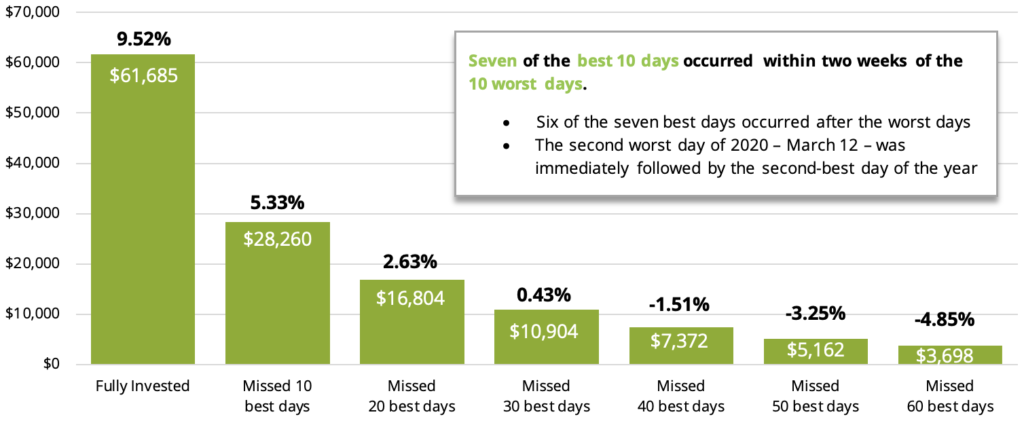

There is a host of negativity currently in the markets and economy. Stock and bond prices have fallen, inflation is running high, interest rates are rising, and the economy is looking like it could fall into a recession. Why not sell everything and wait in cash until things look more favorable? The short answer is that market timing is nearly impossible.

“People who exit the stock market to avoid a decline are odds-on favorites to miss the next rally.”

Peter Lynch, Fidelity Magellan Fund manager (1977-1990)

Performance of a $10,000 investment between January 1, 2002 and December 31, 2021

Source: J.P. Morgan Asset Management analysis using data from Bloomberg. Returns are based on the S&P 500 Total Return Index, an unmanaged, capitalization-weighted index that measures the performance of 500 large capitalization domestic stocks representing all major industries. Indices do not include fees or operating expenses and are not available for actual investment. The hypothetical performance calculations are shown for illustrative purposes only and are not meant to be representative of actual results while investing over the time periods shown. The hypothetical performance calculations are shown gross of fees. If fees were included, returns would be lower. Hypothetical performance returns reflect the reinvestment of all dividends. The hypothetical performance results have certain inherent limitations. Unlike an actual performance record, they do not reflect actual trading, liquidity constraints, fees and other costs. Also, since the trades have not actually been executed, the results may have under- or overcompensated for the impact of certain market factors such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. Returns will fluctuate and an investment upon redemption may be worth more or less than its original value. Past performance is not indicative of future returns. An individual cannot invest directly in an index. Data as of December 31, 2021.

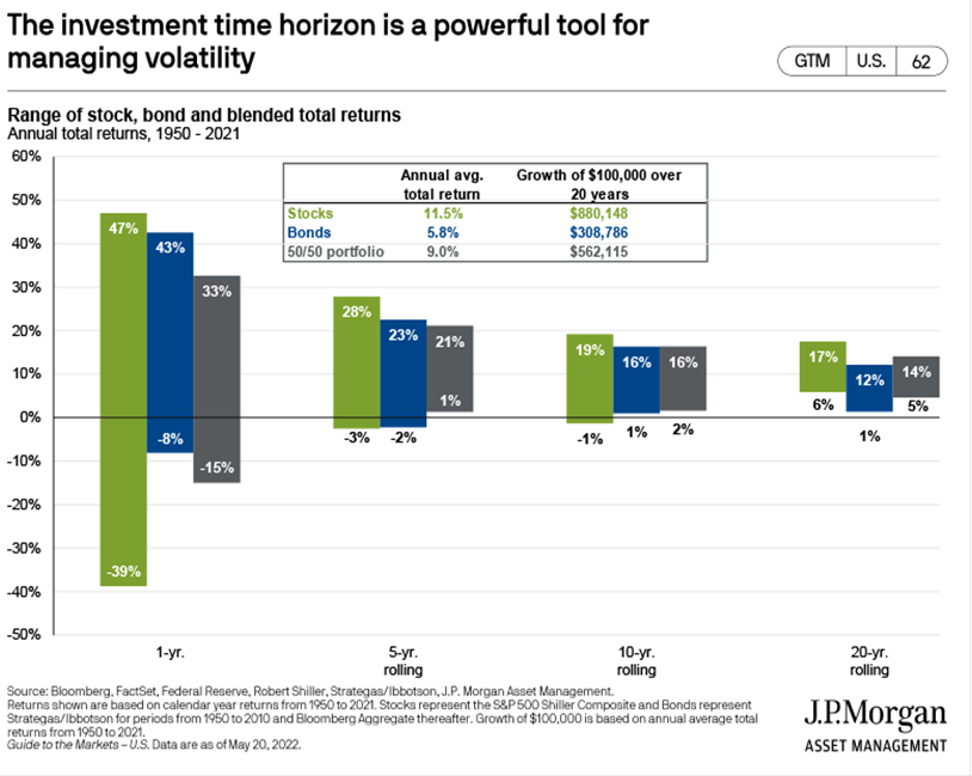

Historically, the stock market goes through periods of recalibration; afterward there typically comes a few years of good performance. No one knows how long or exactly when these begin and end until after it happens. We view these recalibration periods as necessary, even though the process is unpleasant.

We think in terms of multiple years when we invest in stocks. Looking back at history, the longer the investing time period, the greater probability the market return has been positive.

As long-term investors, we recognize that there will always be uncertainty in the economy and the stock market. Since nobody can predict interest rates or the future direction of the economy, our attention is focused on the companies in which we’ve invested.

We look to purchase stocks in companies that have growing businesses that are well managed for the benefit of shareholders. We purchase them only when their price is below our estimate of intrinsic value.

Following recent sharp declines, we believe much of the bad news has been discounted at current prices. While the market could certainly fall further, we often find that these times offer great opportunities to pick up bargains left behind by investors who are panicking. During periods of decline, we look for ways to capitalize on opportunities to locate discounted shares of our favorite companies. Remember, equities have historically been one of the best performing asset classes despite the occasional painful bear markets. We believe that will continue to be the case.

John Heinlein

Managing Director, Chief Investment Officer

The foregoing content reflects the opinions of Hunt Valley Wealth and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. Hunt Valley Wealth is a d/b/a of, and investment advisory services are offered through, Connectus Wealth, LLC, an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Connectus can be found at www.connectuswealth.com.

View your financial assumptions, goals and results of your financial independence analysis

View your financial assumptions, goals and results of your financial independence analysis

View the details of your HVW investment portfolios

View the details of your HVW investment portfolios

View your accounts custodied at Fidelity

View your accounts custodied at Fidelity