Third Quarter Market Review and Commentary

The Federal Reserve remains cautious with its rate hike decisions, hoping to pull off a soft economic landing. The Fed’s latest “hawkish pause” on rate increases pressured equity markets and helped continue to fuel an ongoing historic bear run in the bond markets.

In its attempts to cool inflation, the Federal Reserve has quickly raised rates from near zero to 5.5% recently – a 22-year high. During its most recent meeting in September, the central bank decided to hold rates steady. This action by itself would seemingly be good news for both stocks and bonds; however, the Fed stated that they will need to stay restrictive for “some time” in order to get inflation back down to their 2% target. The central bank wants to see what the full effects of having raised short-term interest rates 11 times over the last 19 months will have on inflation.

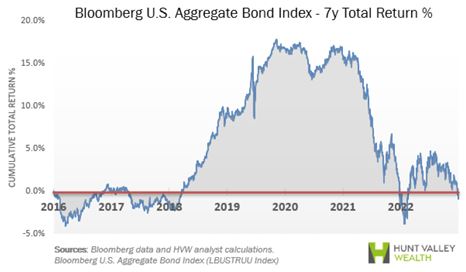

Inflation, as measured by the Consumer Price Index (CPI), has fallen from around 9% last year to 3.7% at last read. The rapid and continual rise in interest rates has had a dramatically negative effect on bond prices. Using the Bloomberg U.S. Aggregate Bond Index as a proxy, an investment in the overall bond market has now provided a negative return for over seven years.

This period is especially significant because this is the only time an investor theoretically would have realized a negative return over any seven-year period since the Index’s inception in 1976.

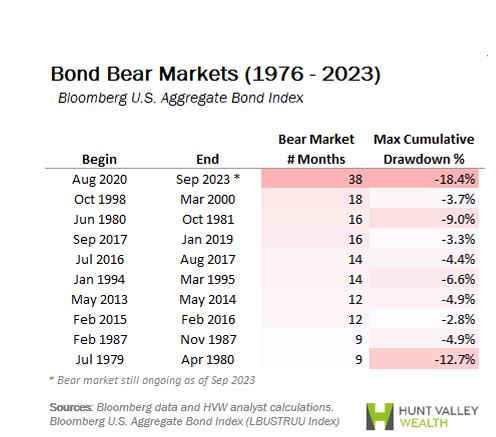

If we zoom out and look at bond market performance over the past few decades, we see that bear markets have been relatively common, but this current one is noteworthy. The following table (right) details the top ten bond bear markets since 1976, ranked by their duration in months. As you can see, at 38 months and counting, this is not only the longest-tenured bond bear market but also includes the most severe drawdown from its peak.

The silver lining to this is that current bond yields are at the highest level that we’ve seen in almost 16 years. Because of these higher yields, we think that bonds are finally starting to look like a reasonably attractive investment.

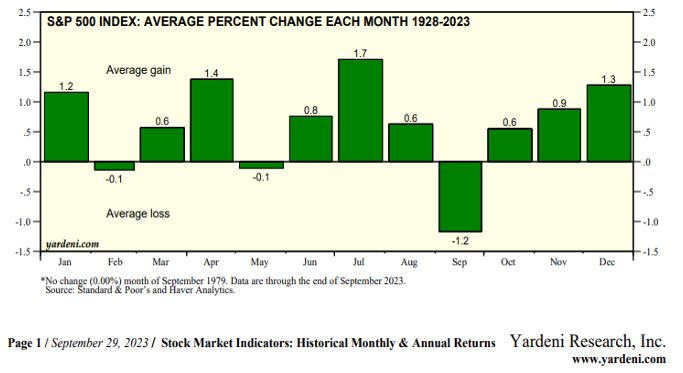

Turning our attention to the equity markets, September has historically been the worst month of the year for stock market performance. This September was no exception, as the S&P 500 index fell 4.8% for the month.

Rising interest rates are typically bad for stock values as future cash flows are discounted by the higher rate, resulting in a lower value.

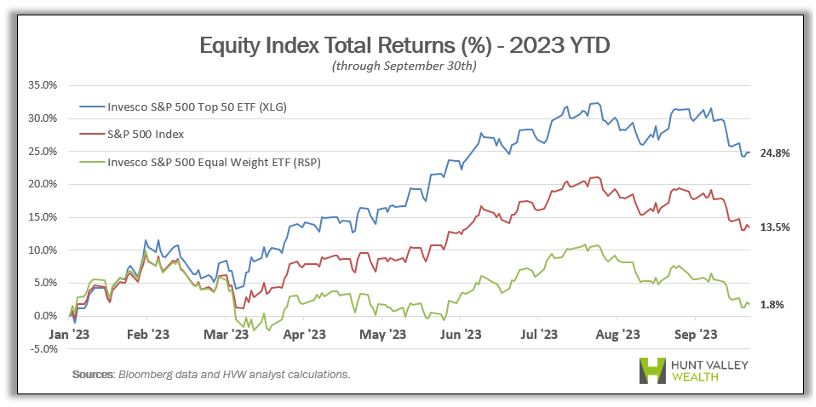

During the 3rd quarter, the Index pulled back 3.3%, but it still remains up 13.5% for the year. Despite the negative return this quarter, the year has been a fairly good one in terms of the Index’s overall performance. However, if you look deeper, and as we noted in the Second Quarter Commentary, the performance has been almost entirely driven by a small group of Mega Cap stocks.

The S&P 500 index is a market cap-weighted index, which means that the larger companies have a larger weighting, and their performance has more influence on the Index’s return. To illustrate this, Invesco’s S&P top 50 ETF (XLG), which is composed of the top 50 largest stocks in the S&P 500, has gained nearly 25% year to date compared to 13.5% for the total Index.

Another way to isolate the influence these large companies hold over the overall Index’s performance is to look at an equally weighted index where all positions carry the same weight regardless of size. As we would expect, Invesco’s equal-weighted index ETF (RSP) generated only a 1.8% return so far in 2023. This dichotomy shows that the vast majority of individual stocks have not performed well so far this year.

The higher bond yields have no doubt rattled equity markets recently. As rates have risen, many investors have avoided and even sold stocks. As long term investors, we look for opportunities during these times. Some relief may be on the way as there is a possibility that the Fed’s rate hikes may be nearing an end. We make no predictions about when this will happen so time will tell.

As we’ve said, it is our belief that equities provide a good long-term hedge against inflation. This is because companies have the ability to grow their cash flows to keep up with rising prices, unlike bonds which have fixed cash flows. With the prices of many stocks falling lower, we continue to seek opportunities to purchase great businesses at discounted valuations for the long term.

The foregoing content reflects the opinions of Hunt Valley Wealth and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. Hunt Valley Wealth is a d/b/a of, and investment advisory services are offered through, Connectus Wealth, LLC, an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Connectus can be found at www.connectuswealth.com.

View your financial assumptions, goals and results of your financial independence analysis

View your financial assumptions, goals and results of your financial independence analysis

View the details of your HVW investment portfolios

View the details of your HVW investment portfolios

View your accounts custodied at Fidelity

View your accounts custodied at Fidelity