The Power of Headlines

In the world of hard-bitten news editors and cub reporters, journalists’ long-held belief is that stories entailing crime, bloodshed, and tragedy captivate readers more than positive news.

As it turns out, their intuition over the years was correct. A recent study published in Nature Human Behaviour found that negative news headlines drive more engagement than positive headlines. In the highly competitive news business where every reader counts, media companies are motivated to focus on the negative to attract and retain readers.

One consequence of this is the impact it has on investor psychology. Frequently, our clients share their concerns and hesitancy to invest because of something negative they have heard or read happening in the economy or around the globe.

Unfortunately, there is always something happening that captures negative headlines. However, as disciplined investors, we need to see beyond the immediacy of the 24-hour news cycle and maintain some perspective on how markets work over time.

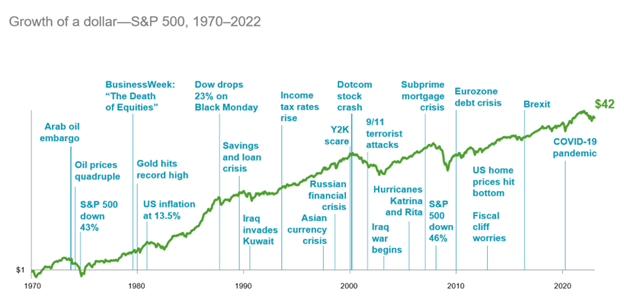

The chart below shows the growth of a dollar invested in a broad equity index, the S&P 500, from 1970 to 2022. As you can see, there is substantial long-term growth despite all the negative-headline-grabbing global market events spanning 50 years.

The chart is an excellent example of why investors are better off ignoring headlines and staying focused on the long term. Just this year, we had headlines warning of the risk of an imminent recession, a raging war in Europe, a banking crisis, and an outbreak of conflict in the Middle East. Yet, the S&P 500 started the year with one of the strongest first-half performances ever, up 19.52% by the end of July.

The primary takeaway for investors is this: negative events have happened, and unfortunately, they will happen again.

So, how can investors navigate the negative headlines and keep moving forward?

One response is to time these events and get out of the market before something potentially bad happens.

Market timing sounds like a good idea. It seems intuitive that we should avoid investing during a war, pandemic, or recession.

However, in practice, this approach is incredibly complicated and challenging.

First, you have to predict the event before it happens. Second, you must accurately anticipate the market’s reaction to the event. Third, you have to do it before prices reflect that others are also predicting what you expect to happen.

For example, it will do you little good if you correctly anticipate the onset of a recession that sends markets tumbling if that prediction is widely known and prices have already changed to reflect it.

Suppose you get all those things right and have sidestepped an adverse event. You must buy back into the market at the right time (typically when things seem bleakest and you are the least inclined to reinvest). If you’re unsure of the timing and wait for the market to move in a positive direction to give you a sense of confidence, by the time you get back in, you will have missed the initial jump in prices, which is often the lion’s share of the rebound.

For these reasons, this approach is tough to get right, and when it doesn’t work, it ends up hurting your performance more than if you have just stayed put and endured the negative headlines and adverse events.

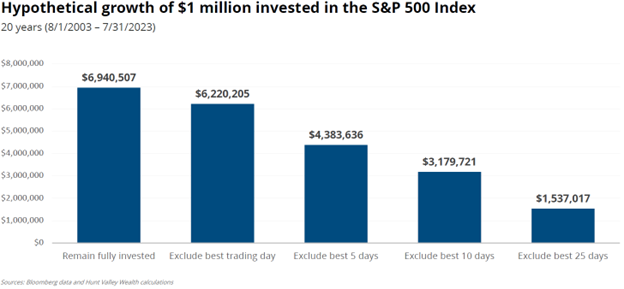

Many investors fail to realize that the best days in the market tend to happen clustered among the worst days. If you’ve moved out of your investments to avoid those bad days, you’ll likely miss the good days. The impact that can have on your portfolio is significant.

This chart shows the hypothetical impact on a million dollars invested across various scenarios from 2003 to 2023.

In one scenario, remaining fully invested across the 20 years resulted in a portfolio that has grown close to $7 million. However, missing the 10 best days over the 20 years substantially impacts the portfolio, costing over $3.7 million in gains.

Jumping in and out of markets to avoid adverse events may seem like a reasonable strategy, but missing just a few days can do real harm to your portfolio.

While it can be difficult to endure negative headlines, history has shown that staying patient and fully invested is the optimal strategy.

Disclosures:

The information contained in this webinar is provided for informational purposes only, and should not be construed as investment advice or a recommendation to purchase or sell a security. Investing involves the risk of loss that clients must be prepared to bear. This document contains forward-looking statements of opinion, belief, and expectation about the future. Actual results could differ materially from such statements and our opinions are subject to change without notice.

View your financial assumptions, goals and results of your financial independence analysis

View your financial assumptions, goals and results of your financial independence analysis

View the details of your HVW investment portfolios

View the details of your HVW investment portfolios

View your accounts custodied at Fidelity

View your accounts custodied at Fidelity