A Webinar Recap: The Balancing Act. Wellness, Family, and Retirement for the Sandwich Generation

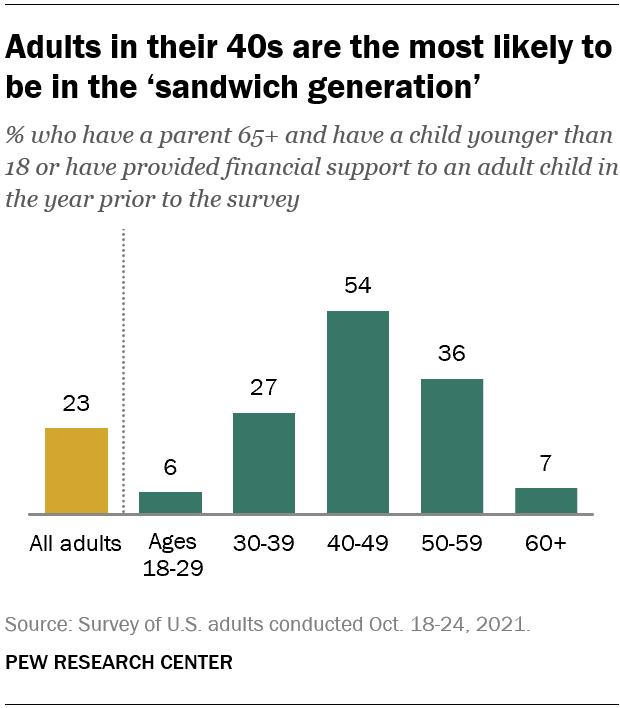

54% of Americans in their 40s, find themselves in the challenging position of caring for their aging parents and their own children.

The Research

According to a recent study conducted by Pew Research Center in 2021[1],

54% of Americans in their 40s find themselves in the challenging position of simultaneously caring for their aging parents and their own children, a situation aptly termed the “sandwich generation.”[2] In our recent webinar, The Balancing Act: Wellness, Family and Retirement for the Sandwich Generation, we explored ways to maintain a high quality of life while juggling caregiving responsibilities.

So what is the Sandwich Generation?

Dani Ryan, CFP®, CDFA®, CRPC®, Senior Wealth Advisor here at Hunt Valley Wealth, introduces the term “sandwich generation” and describes them as adult children of the elderly who are sandwiched between their aging parents and their own maturing children and are subjected to a great deal of stress.

Who is part of the Sandwich Generation?

Individuals in their 40s and 50s typically make up the sandwich generation, but people in their 30s and 60s can also be included. According to a 2020 Census Report[3], life expectancy has increased since the term sandwich generation was coined which affects their financial independence. The increasing lifespan and later age for childbearing have contributed to the expansion of the sandwich generation.

Now that we have a better understanding of who the sandwich generation is and the many stresses being in this generation can cause. Let’s explore ways to live a high-quality life, while caring for loved ones and planning for your own retirement.

3 Ways to Avoid Caregiver Burnout Through Self-Care

1. Travel & Wellness: Travel trends such as multi-generational family vacations, the importance of having digital documents, and how travel can serve as a vital component of your self-care toolkit.

There are many reasons for travel, a poll conducted during our recent webinar showed that people want to experience new destinations as their main reason for travel. Guest panelist Anita Carson, President of Villas and Voyages shared how travel allows us to collect moments and not things, which can contribute to our well-being. Research shows that lasting joy doesn’t come from objects but rather from experiences.

A 2018 study published in the journal Tourism Analysis[4] found that frequent travelers tend to have greater life satisfaction and can lead to a number of positive benefits, such as increased self-awareness, reduced stress, and improved mental and physical health.

Here are some of the trends, tips, and destinations that can help you embrace these benefits:

Travel Trends:

- Spa & Wellness

- National Parks

- Nature & Sustainability

- Reconnecting with Loved Ones

According to the National Park Service[5], 312 million people visited the national parks in 2022. Did you know that visiting national parks can improve your physical and mental health? It can lower cholesterol, eliminate inflammation, and even boost your immune system.

Top Destinations: (Great for Multi-generational Trips)

- Iceland

- Portugal

- Ireland

- Costa Rica

Travel Tips:

- Hire a Professional

- Pack light and consider air tags

- Get travel insurance

- Keep up on your passport renewal

- Explore Global Entry

Travel can play a vital role in our mental health but we also need to take care of our responsibilities at home, while we travel. The next form of self-care is Care Management and making sure our family members have the proper support and resources in place when needed.

2. Care Management: Insights into effective care management, avoiding care-giver burn-out, and helpful resources to ensure the well-being of your aging parents and family members.

Juggling the needs of aging parents and children can be demanding, often leading to stress and burnout. Seeking support is essential for individuals in this demographic to maintain their well-being and effectively manage their responsibilities. Our webinar delved into strategies for finding the appropriate support, whether at home, out, or while traveling

Ellen Platt, Med, CRC, CCM, is the founder of The Option Group which focuses on providing services and expertise on care management and often works with the sandwich generation. Knowing what services are available to help caregivers, such as home safety evaluations, medical care coordination, and eldercare counseling, is important. While traveling, remember to plan ahead, pack the correct medications, and understand the accommodations needed for those being cared for; which will in return help relieve stress on the caregiver.

One of Ellen’s recommendations is to create a companion card to use when traveling, dining out or even at home. This allows grace for the caregiver and those being cared for in a variety of situations.

Understanding the existing support options available and the advantages of care management is critical for the family’s well-being, as is planning for the future. The significance of Financial Planning, is the final form of self-care discussed in the recent webinar.

3. Financial Planning: Strategies to help you create a plan for your own retirement while meeting the needs of your family.

The sandwich generation are often primary caregivers for multiple generations and are stretched thin. So, it’s important for them to keep an eye on their own financial success and consider partnering with a financial advisor to guide them in the right direction.

Jay Schuman, CFP with Hunt Valley Wealth walked us through the key areas of focus for each generation starting with the elderly.

- Grandparents (your parents): Understand their financial situation and review their insurance plans, wills and trust documents, care management options, health directives, etc.

- Sandwich Generation (care-givers): Look into tax-advantage accounts and life insurance policies, share the burden with siblings, and revisit your financial plan often.

- Children: Prioritize college savings, set budget and expectations, and stay informed of insurance policies up until the age of 26.

Conclusion:

In today’s complex world, managing the needs of three diverse generations can be a daunting task. Watch our webinar on demand, to learn from our panel of experts about the intricate aspects of maintaining a high quality of life, while navigating the demands of caregiving.

The “The Balancing Act” is the second installment in the Hunt Valley Wealth webinar series. Look out for our next webinar coming January 24, 2024.

*Citations

1. Pew Research Center Study

2. JSTOR: The ‘sandwich’ generation: adult children of the aging

3. 2020 Census Report: Living Longer: Historical and Projected Life Expectancy in the United States, 1960 to 2060

4. The Journal of Tourism Analysis: The Influence of Nationality on the Generation of Tourist Satisfaction with a Destination

5. National Park Service: 2022 Visitation Highlights

View your financial assumptions, goals and results of your financial independence analysis

View your financial assumptions, goals and results of your financial independence analysis

View the details of your HVW investment portfolios

View the details of your HVW investment portfolios

View your accounts custodied at Fidelity

View your accounts custodied at Fidelity