The Balancing Act: Caring for Your Aging Parents

In the ever-evolving landscape of family dynamics, care management is rapidly emerging as a critical challenge facing adults in the “sandwich generation” – those sandwiched between caring for elderly parents and their children.

The need for caregiving is dramatically growing with an increasingly older adult population and people living longer. According to the PEW Research Center, roughly two-thirds of adults (66%) believe grown children should take some responsibility for providing caregiving for an elderly parent who needs it.1

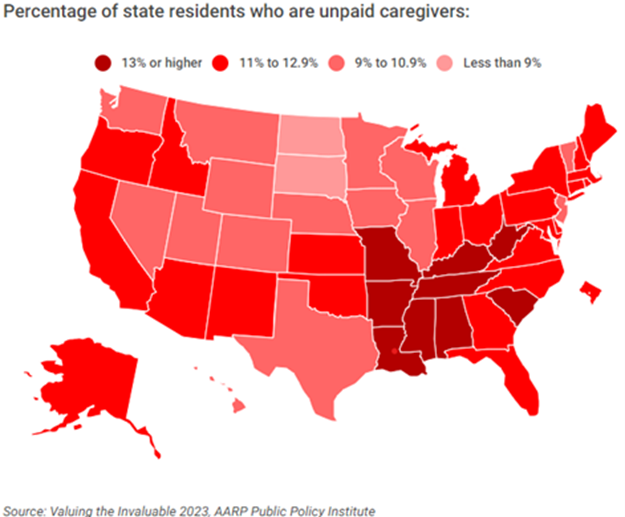

More and more, they are. AARP estimates that over 38 million unpaid family caregivers provide an average of 18 hours of care per week for a total of 36 billion hours of care.2

With the responsibilities and challenges of caring for our aging loved ones increasingly falling upon us, the need for a thoughtful and holistic approach to planning for caring for aging parents with grace and compassion is profound.

With thoughtful planning, care management can be more than a reactionary response; it can provide a proactive strategy that encompasses anticipating the evolving needs of your aging family members as they physically or cognitively decline or develop a condition that precludes them from living independently.

Each family’s situation is unique, so care planning should also be. As you create a care plan, consider the following areas:

- Health care – review health insurance and what is covered, identify any health conditions, schedule of medications, or any issue that requires special care. Make sure legal documents such as a living will and durable power of attorney for health care are in place, and advance directives for medical care are identified, such as preferences for life-sustaining or supporting treatment.

- Cognitive care – Regular cognitive assessment is essential as we age. Currently, 1 in 3 seniors dies with Alzheimer’s or another form of dementia. Screening can help with early diagnosis and allow families to plan for appropriate long-term care.

- Financial planning – Budget for income and expenses (including accelerating healthcare costs). Financial documents such as a will, power of attorney, and trusts should be prepared/updated and held in a centralized location.

Enjoying the time you have with family often involves travel, but for those taking care of several generations, this can be a real challenge. Ellen Platt, a seasoned expert from the Option Group, recently shared invaluable insights with us on managing your travel experience so it can be an enjoyable affair filled with shared experiences and cherished moments.

Ellen recommends meticulous pre-planning when traveling with aging family members. This goes beyond booking flights and accommodation; it involves creating a comprehensive roadmap that anticipates every conceivable need and ensures a smooth journey from start to finish. She recommends the following:

- Create and take a well-organized folder that includes legal papers, medication lists, allergies, and dosages. This ensures that, in any situation, you have the necessary information readily available, reducing potential stressors during your journey.

- Prepare for the unexpected by packing extra clothes, ensuring you have chargers, and bringing extra hearing aid batteries, incontinence, and diabetic supplies.

- Additionally, various entertainment items—books, puzzles, or electronic devices—can make the journey more enjoyable for aging family members, fostering a positive travel experience.

- If warranted, create a companion card to discreetly hand to a waiter/waitress or somebody at the hotel to give them insight that your senior traveling companion may get a little bit flustered or may need some extra time.

Navigating the landscape of caring for aging parents can be demanding. However, planning to address the needs and challenges that may arise proactively can mitigate stress and transform the caregiving experience into a well-orchestrated endeavor.

As you embark on the journey of caring for your aging parents, you are not alone.

At Hunt Valley Wealth, we understand that your financial well-being is intertwined with the well-being of your family. Our commitment to providing comprehensive insights extends beyond investments. We stand ready to support you not just in your financial endeavors but also in navigating the seasons of life, ensuring that you and your loved ones thrive at every stage. Please don’t hesitate to reach out.

Disclosures:

The information contained in this webinar is provided for informational purposes only, and should not be construed as investment advice or a recommendation to purchase or sell a security. Investing involves the risk of loss that clients must be prepared to bear. This document contains forward-looking statements of opinion, belief, and expectation about the future. Actual results could differ materially from such statements and our opinions are subject to change without notice.

- Greenwood, S. (2023, November 2). Family responsibilities | Pew Research Center. Pew Research Center’s Social & Demographic Trends Project. https://www.pewresearch.org/social-trends/2023/09/14/family-responsibilities/ ↩︎

- Horovitz, B. (2023b, July 14). New AARP report finds family caregivers provide $600 billion in unpaid care across the U.S. AARP https://www.aarp.org/caregiving/financial-legal/info-2023/upaid-caregivers-provide-billions-in-care.html ↩︎

View your financial assumptions, goals and results of your financial independence analysis

View your financial assumptions, goals and results of your financial independence analysis

View the details of your HVW investment portfolios

View the details of your HVW investment portfolios

View your accounts custodied at Fidelity

View your accounts custodied at Fidelity