Second Quarter Market Review and Commentary

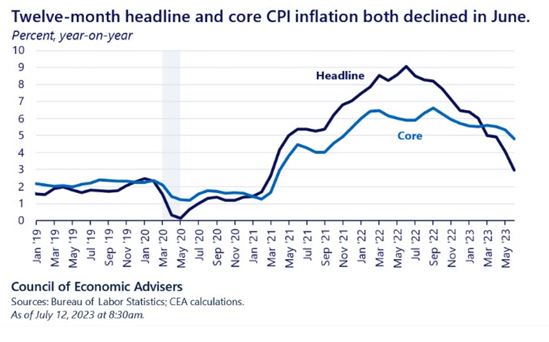

Inflation continued to moderate in the quarter, and earnings proved stronger than expected. However, the market remains cautious on fears of further rate hikes and an expectation that a recession may still be unavoidable.

The stock markets had another strong performance in the second quarter of 2023, with the S&P 500 index rising 8.7% while the Nasdaq Composite index outperformed, rising 13%. The market was helped by the absence of a recession, resilient earnings, and excitement about Artificial Intelligence (AI), which improved investor sentiment and valuations in the technology sector.

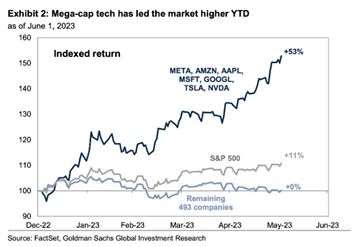

There were significant divergences in performance in the stock market. Seven stocks (a.k.a. “The Magnificent Seven”) account for roughly 30% of the entire S&P 500 Index (which is considered a proxy for the market), but contributed more than 80% of the Index’s returns so far in 2023. The rest of the stocks had a flat performance on balance. These include:

1. Alphabet (GOOG) +36%* 2. Microsoft (MSFT) +43% 3. Amazon (AMZN) +55% 4. Apple (AAPL) +50% 5. Meta (META) +138% 6. Tesla (TSLA) +113% 7. Nvidia (NVDA) +190%

*2023 Total Return YTD through June 30th

Normally, when the market is up a lot, a large percentage of stocks are up as well, so this extreme divergence is very unusual. Notably, the S&P 500 index, which is more traditionally quoted but weighted by market cap, gained 8.7% in the quarter, while the S&P 500 equal-weighted index only gained 4%. Investors went into the second quarter on high alert for a recession and thinking the Fed could soon be cutting rates. By the end of the quarter, there was no economic downturn in sight, and the Fed was expected to keep rates higher for longer. Inflation did subside, however, it remained stubbornly high despite the continuous Fed action of unprecedentedly rapid hikes. The U.S. Economy remains resilient so far despite the Fed’s most restrictive monetary policy in forty years. So far, the economy is defying predictions of a downturn. First quarter gross domestic product GDP was recently revised upward from 1.3% to 2%, the labor market is strong, and unemployment is historically low. The idea that the Fed can orchestrate a “soft landing” is beginning to seem credible. Despite inflation trending in the right direction, the Federal Reserve has maintained a hawkish tone regarding interest rate policy. Wall Street, however, is skeptical that they will still need to raise rates multiple times. It appears that the market is anticipating that the bank is near the end of its tightening cycle. Second quarter earnings season has begun, and Wall Street’s attention will soon be focused on the earnings reports. The reports should provide additional insight into the health of the economy and how Corporate America is adapting to a slower growth environment.

John Heinlein Managing Director, Chief Investment Officer

The foregoing content reflects the opinions of Hunt Valley Wealth and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. Hunt Valley Wealth is a d/b/a of, and investment advisory services are offered through, Connectus Wealth, LLC, an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Connectus can be found at www.connectuswealth.com.

View your financial assumptions, goals and results of your financial independence analysis

View your financial assumptions, goals and results of your financial independence analysis

View the details of your HVW investment portfolios

View the details of your HVW investment portfolios

View your accounts custodied at Fidelity

View your accounts custodied at Fidelity