Navigating a Volatile Market

Volatile markets can be unsettling if an investor is focused on daily news headlines and minute-to-minute price movements. Broad market volatility can come at the hand of many exogenous forces, including (1) macroeconomic events like swings in interest rates, inflation, production, or employment levels, (2) political regime changes, (3) geopolitical instability, or (4) fiscal policy changes like tax rates, or significant legislative, regulatory changes. Sometimes, changes within a given industry or company can cause a large enough ripple effect to impact a broader segment of the economy. In extreme cases, market dynamics like excessive margin trading or the misuse of leveraged assets or derivatives can drive prices further from fair value. Regardless of the root cause, it often leads to the thing financial markets dislike most… uncertainty.

This piece focuses on volatility in the context of spiking inflation and the threat of rising interest rates since they are among the most pressing issues today. That said, there are a few key takeaways to take away from this piece:

- Periods of heightened volatility are normal and should be expected periodically over an economic cycle

- Regardless of the volatility’s root cause, our process often remains the same.

- We don’t believe volatility equates to risk; we view the potential for permanent loss of capital as the true risk.

- We view volatility as an opportunity and look to exploit turbulent markets.

What are we doing?

We diligently review all our positions to assess whether our investment thesis has changed or the business has been impaired. We are also sifting through the sold-off stocks to uncover potential opportunities. We see this as more of a macro-driven sell-off. In our research, we are finding that many businesses are just as strong, with minimal impact from the current economic backdrop. In fact, we are finding that some are even stronger and better positioned after retaining much of the pulled-forward growth gained during the pandemic. After significant drawdowns in their share prices, many of these businesses are trading below their pre-pandemic valuations. As such, we believe there is currently a wide disconnect between price and value in certain pockets of the market. We are treating this as an opportunity to initiate or build positions in some great businesses.

What kind of companies are we looking for?

In turbulent markets, we want to own businesses that can withstand a pressured economy or even a potential recession. We’re looking at this through the lens of a potentially high inflationary environment today, and businesses with the following virtues tend to perform better. That said, this list also represents the qualities we would look for in a normal economic environment.

- Pricing power – the ability to raise prices with little change in customer demand

- Toll-based revenue – collecting a fee on a pool of transaction volume, with or without inflation

- Asset-light businesses – fewer expenses and capital investments to make at inflated prices

- Strong balance sheets – reasonable debt levels and ample cash to remain flexible and opportunistic

- Durable competitive advantages – the ability to earn high returns on capital over long periods

Volatile markets and challenging economic backdrops often forge the most dominant businesses of the next decade or longer. Two things commonly happen during this time. First, weaker companies are exposed if they don’t have a durable competitive advantage, causing many to fail and lose market share to their competitors. Second, depressed stock prices make smaller beaten-down businesses more attractive acquisition targets, especially in nascent or changing industries ripe for consolidation. In either scenario, the better-managed businesses with the strongest assets and widest economic moats stand to benefit and are likely to become more formidable in the future.

This is where we are looking.

We believe the market has unjustly punished many great businesses in this sell-off. When rates started to rise, the market lost any appetite for growth stocks, especially those that were pandemic beneficiaries. Investors indiscriminately sold anything with a growth moniker or a high multiple. However, these are not all equal, and some great businesses got “thrown out with the bathwater.” Many of these beaten-down companies have proven profitability, strong underlying economics, and durable competitive advantages. Some target massive markets with clear growth visibility and ample optionality to sustain a long growth runway. Today, some of these are trading below pre-pandemic prices, despite being fundamentally stronger businesses – creating a potentially compelling opportunity.

Again, this is where we are looking.

What are we not doing?

We are not panicking or making rash decisions.

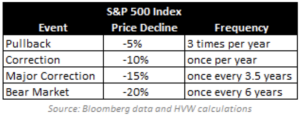

History has shown us that swings like this are actually quite normal and should be expected periodically. History shows that the S&P 500 Index typically goes through a 5% drawdown three times per year, on average, and a 20% drawdown once every six years.

We don’t believe volatility equates to risk; rather, we view risk as the potential for permanent loss of capital. The good news is that these regular drawdowns can create attractive buying opportunities. Therefore, we welcome short-term volatility and view it as a friend of the disciplined and opportunistic long-term investor. To paraphrase Benjamin Graham from his seminal book, The Intelligent Investor: An investor overly concerned with irrational short-term price swings transforms their basic advantage into a disadvantage (Graham, 2003).

We are not making drastic changes to our investment philosophy. We are still hunting for what we consider to be high-quality businesses that can operate as long-term compounders. This includes reviewing our existing positions to ensure that they still meet our stringent criteria.

A key part of the compounding equation is a business’s ability to reinvest capital internally at high rates of return. Reinvestment opportunities are the engine that drives growth, and retained cash flows are the fuel that allows it to compound over long periods. The more reinvestment opportunities, the longer the compounding can go on. Companies in this mold tend to be more growth-oriented and, we believe, better positioned for long-term outperformance. This is why the portfolio has been shifting to more of a growth-bent over the years. We believe this is where the opportunity lies, and even more so after this sell-off. Therefore, we will continue to sift through these beaten-down stocks to find compelling long-term investments.

Value stocks have outperformed growth over the past year for the first time since 2016. We don’t have significant exposure to this category because we tend to avoid industries like energy, banks, utilities, and real estate. These are solid businesses operating in essential industries and will have periods of outperformance. However, they tend to compound at lower rates over the long term. We would consider them as satellite positions but prefer to focus our attention elsewhere on what we consider higher-quality businesses that could become core holdings.

We are not thinking short-term – we are focused on long-term wealth creation. Our investment strategy is built for long-term performance, with the goal of generating a market-beating return over longer periods. Our strategy is not built to outperform in every short-term economic environment. We believe structuring portfolios to chase short-term performance would be a mistake and detrimental to our clients’ long-term wealth potential.

We don’t believe investors can accurately predict what prices will do in the next week, month, or year. The market can be quite irrational and unpredictable in the short term. However, it is much more rational over the long term, and prices tend to converge toward a business’s intrinsic value over time. Therefore, when we initiate a position, we typically do so with a targeted five to ten-year investment horizon – with the optimal holding period being forever.

Sometimes we find attractive investment opportunities, but we are early in buying them. The investment may be priced to generate strong returns during our targeted holding period, but shares sell off after our purchase. In this happens, and we find a flaw in our thesis or something materially changes, we will cut our losses. But if not, buying may still have been the right decision, even if we are early. The investment can still be a long-term outperformer, but it may take time for the market to see the same value we see and adjust the price to reflect that value.

We do not use derivative instruments or short stocks as a hedging strategy. We do not view ourselves as market-timers either. The mere concept of day-trading or short-term swing trading is antithetical to our core investing philosophy. We are looking for durable businesses with growth runways and reinvestment opportunities that need time to compound shareholder capital. Frequent trading would interrupt this compounding mechanism and potentially create taxable events. Moreover, studies have shown that few can do this sustainably and successfully, so we don’t try to play this game. The following quote from former fund manager Peter Lynch sums this up best:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch

We do not advise selling and moving to cash. We are looking to put more cash to work in this market. You may be thinking, why shouldn’t we sell here and move to cash? Inflation could remain elevated for a while, interest rates are likely to continue rising, and we could be facing a potential recession or a period of stagflation.

There are a few reasons why we would advise against this. First, economic moves are notoriously difficult to forecast, and even the brightest investors admit that trying is a fool’s errand. Second, if inflation persists or we enter a recession, we don’t know how long it will last or how severe it will be. Third, stock market moves generally precede economic moves. If we wait for an all-clear signal, we could miss the ensuing rebound rally. In essence, we are business analysts, first and foremost. We prefer to stick to things within our control and circle of competence rather than attempting to time the market or make predictions about the broader economy.

However, our biggest concern with selling stocks and moving to cash is that it could be a much riskier long-term strategy. That may sound counterintuitive, but consider the following unintended risks:

- You are battling against inflation either way. Cash accounts offer a safe and predictable return. But even with the paltry interest rate, you would still earn a negative real return, and your future purchasing power is diminishing with higher inflation. Sitting in cash removes your upside potential and ability to keep up with inflation. The takeaway: During an inflationary environment, you want to own real assets, not cash.

- You have to be right twice for this to work. In addition to (ideally) selling somewhere near the high, you also have to decide when to get back into the market. Studies have shown that when employing this strategy, investors are often late to sell and re-enter the market. The average DIY investor underperforms the market over the long term, and market timing attempts like this are a key reason for it.

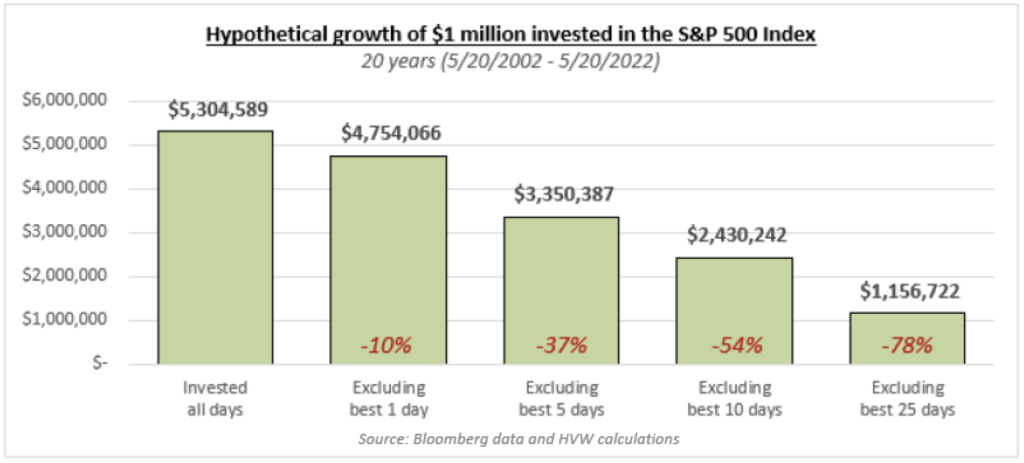

Consider the following scenario where an investor exits the market and moves to cash, even for a short period of time. Being out of the stock market and missing the single best day of the last 20 years would result in 10% lower future wealth (see chart below). Missing the top five days would result in 37% lower wealth. After you account for inflation during those idle periods, your real wealth and future purchasing power are even lower.

Volatile markets invite investors to make hasty decisions that can have lasting implications on their long-term earning potential. As humans, we have an innate tendency to want to make changes in times like this. But in many cases, history has shown us that the best move is to remain patient. Periods of heightened volatility are usually not the best time to make wholesale changes, and this time is no different.

Our advice is to work with your advisor to build a financial plan with a sound investment strategy and stick to it. Take solace in knowing that we are diligently working to position your portfolio for long-term success to help you achieve your financial goals.

To read the whitepaper click here

Matthew Holman, CFA

Sr Equity Analyst/Asst Portfolio Manager

The foregoing content reflects the opinions of Hunt Valley Wealth and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. Hunt Valley Wealth is a d/b/a of, and investment advisory services are offered through, Connectus Wealth, LLC, an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Connectus can be found at www.connectuswealth.com.

View your financial assumptions, goals and results of your financial independence analysis

View your financial assumptions, goals and results of your financial independence analysis

View the details of your HVW investment portfolios

View the details of your HVW investment portfolios

View your accounts custodied at Fidelity

View your accounts custodied at Fidelity