Managing Spending Needs

We often discuss our view that volatility does not constitute risk but creates opportunities for intelligent investments and divestitures. One caveat to this philosophy, however, is that it only holds under one important condition: our time horizon must be materially longer than that of the average investor. When we meet this condition, we detach ourselves psychologically from short-term price swings, which can cause distress and rash decision-making. We also remain indifferent to the sequence of returns. This can be a powerful advantage in the market.

This investment approach is easy to conceptualize but difficult to practice. The reality is that we do not live our lives in the future; we live them in the present, and we often have short-term spending needs which help us attain a desired quality of life. This can pose challenges to maintaining a long time horizon.

How do we reconcile short-term spending needs with long-term wealth creation? The answer lies in a portfolio management strategy called cash flow matching. The objective is straightforward – match the cash requirements of a liability (e.g., spending need) with the cash flows of an asset. If we know we will need $10,000 in one year, we should buy an asset(s) that gives us a $10,000 cash infusion in one year. These cash flows need to be predictable, meaning we want a fixed income instrument. Our preference is a Certificate of Deposit (CD), which is insured by the FDIC up to $250,000 per bank.

Many of us have recurring spending needs, which means that we must include multiple CDs in the portfolio – the “CD Bucket,” as we like to call it.

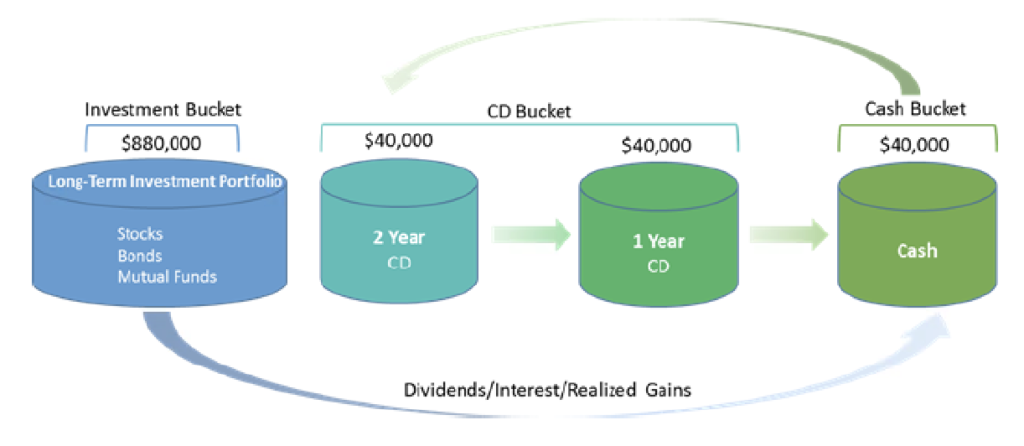

Take a client, for example, which has $1 million dollars in their portfolio and needs $40K of cash each year for the next three years to fund their child’s education. How would we approach this situation?

First, we would keep one year’s worth of cash needs in the portfolio (Cash Bucket). This will fund the first year of tuition. We will then “ladder” the CDs, placing $40,000 into a CD that matures in one year and another that matures in two years. As each year rolls by, the CDs will mature and replenish the cash portion of the portfolio, allowing the client to meet their withdrawal needs as they arise.

Congruently, we would place $880,000 into a long-term investment portfolio of stocks and bonds (depending on the allocation model). This is our “Investment Bucket.”

This portfolio construction accomplishes our two main goals: (1) ensuring that the tuition can be paid, and (2) positioning the portfolio for long-term success. Note that we can adjust the buckets to accommodate each client’s unique withdrawal needs – another advantage of this flexible strategy. As the investment bucket grows, it funds the cash bucket as well. This can be allocated to additional CDs if the ladder needs to be built into future years.

The beauty of the bucketing approach is that it removes our reliance on short-term performance. We can withstand volatility without worrying about finding cash each year for the spending requirement. By avoiding the need to sell stocks in a downturn to fund our expenses, we mitigate the dreaded sequencing risk.

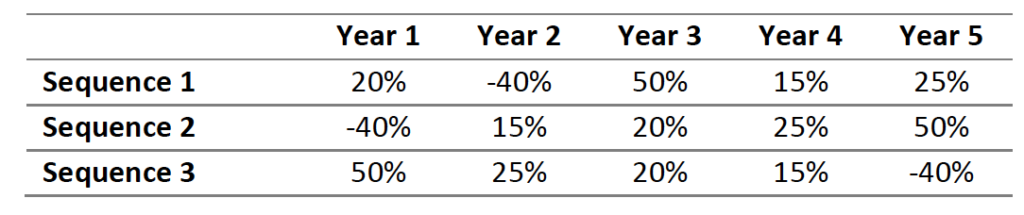

Sequencing risk is the risk that the order in which our interval returns occur will have a negative impact on our end portfolio value. This only occurs if we have income/withdrawal needs. If we have no such needs, then the sequence of returns is inconsequential to our portfolio value in the long run. Consider, for example, $1,000 invested in a stock that realizes the following annual price changes:

Each sequence has the same five return figures, just rearranged in a different order. In all three cases, the end value of the portfolio (assuming zero dividends) is $1,553. The order in which our returns are realized does not affect our ultimate return because we did not withdraw money from the portfolio.

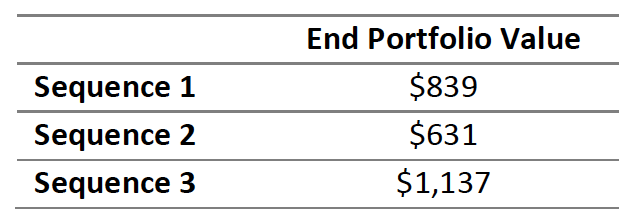

Once we introduce a withdrawal need into the equation, the order in which the returns are realized suddenly makes a difference to the end value of the portfolio. Consider the same three scenarios above, but this time the client withdraws $100 at the end of each year. The end values of the portfolio are now:

Under Sequence 3, we would have 80% more money at the end of Year 5 than under Sequence 2 while withdrawing the same amount of money each year. The only thing that changed was the order in which the annual price returns occurred. Without a strategy to immunize the portfolio, we would be forced into a weak position whereby a poor performance in early years dramatically reduces the long-term potential of the portfolio.

We believe a cash flow matching strategy – specifically the bucketing approach – decreases our reliance on the sequence of returns. This lengthens our time horizon and converts volatility from a risk (as it is defined in Modern Portfolio Theory) into a source of opportunity. We view this as one of the key advantages of our fundamental investment approach.

To read the whitepaper click here

Louis Foxwell, CFA

Sr. Equity Analyst/Asst Portfolio Manager

The foregoing content reflects the opinions of Hunt Valley Wealth and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. Hunt Valley Wealth is a d/b/a of, and investment advisory services are offered through, Connectus Wealth, LLC, an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Connectus can be found at www.connectuswealth.com.

View your financial assumptions, goals and results of your financial independence analysis

View your financial assumptions, goals and results of your financial independence analysis

View the details of your HVW investment portfolios

View the details of your HVW investment portfolios

View your accounts custodied at Fidelity

View your accounts custodied at Fidelity