Fourth Quarter Market Review and Commentary

2022 was a tumultuous year for financial markets.

There was no shortage of market drama in 2022. Instability gripped the world as the war in Ukraine raged, and a potential energy crisis loomed. Disrupted global supply chains led to shortages and surging inflation in select industries. Consumers continued buying, but their confidence weakened as the year came to a close. Central banks simultaneously raised interest rates higher and at a faster pace than investors expected in an attempt to combat runaway inflation.

With that economic uncertainty as a backdrop, it is not surprising that 2022 was a challenging year for investors as both stock and bond markets performed poorly. This is a rare occurrence, as equities and bonds typically have an inverse relationship.

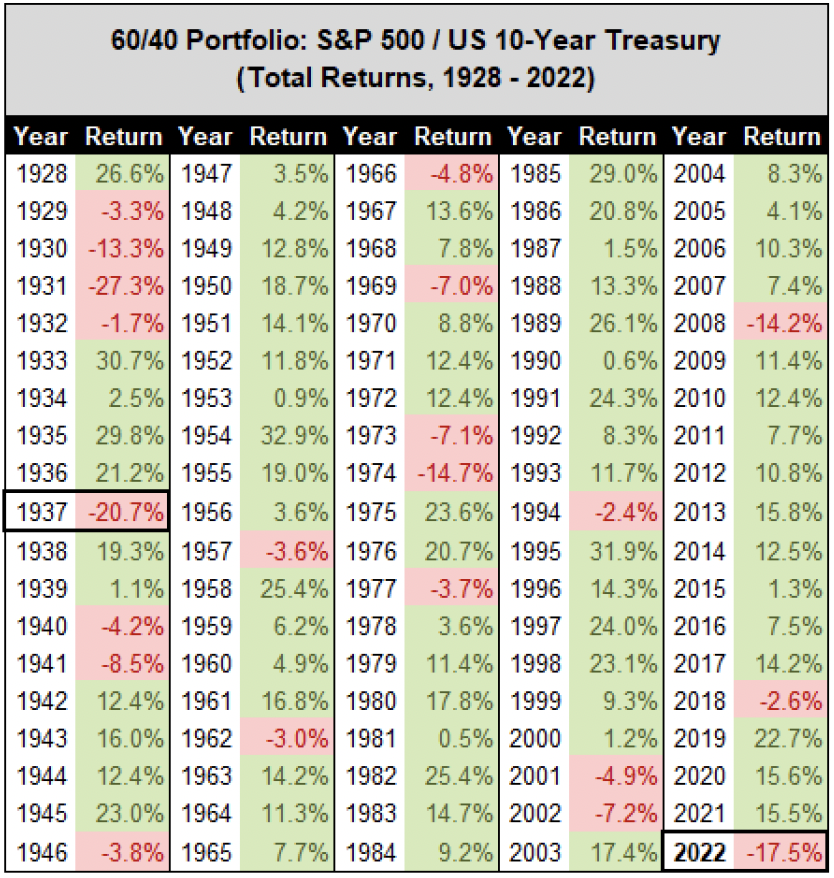

The standard “60/40 portfolio” had its worst annual performance since 1937. Refer to the next chart showing annual past returns courtesy of Charlie Bilello of Pension Partners, LLC.

Source: Data from Charlie Bilello of Pension Partners, LLC. (as of 12/31/2022)

Historically, stocks don’t perform well when the Federal Reserve raises interest rates due to the higher discount applied to future cash flows. Meanwhile, high inflation combined with the restrictive actions of the Fed had a detrimental effect on bond prices.

Turning the page to 2023, the new year begins with many of the same headwinds that hurt the market in 2022. The Fed’s battle with inflation is not over, and it may come at the expense of the economy. Despite this, we still see a few reasons for optimism:

- In our opinion, much of this negativity has been or is in the process of being reflected in sharply lower stock prices.

- History teaches us that investment opportunities emerge from bad news, excessively bearish sentiment, and instability.

- There seem to be a number of economic buffers that weren’t present in previous downturns. For example, inflation is moderating, the jobs market is strong, and the banking sector is in relatively good shape.

Of course, there may be more shoes to drop, and the markets could fall further. Many pundits forecast a minor recession, but a longer or deeper one is always possible.

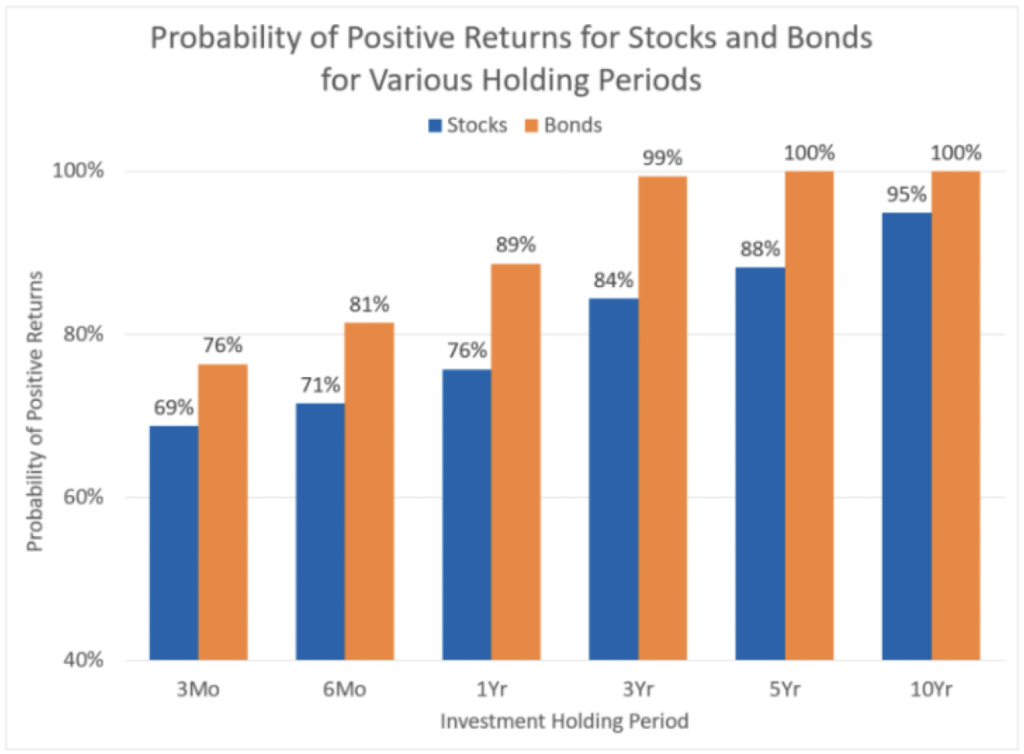

While guessing the direction of tomorrow’s stock prices attracts a large audience, we believe that focusing our attention on the next ten years and not the next ten months will likely be more profitable. See the chart below for a historical perspective on the performance of stocks and bond returns through various holding periods.

Source: Morningstar Direct utilizing IA SBBI US Large Stock TR USD Ext to represent Stocks and IA SBBI US IT Govt TR USD to represent Bonds between 12/31/1925 and 7/31/2022. Past performance is not indicative of future returns.

We often mention the ineffectiveness of market timing and the futility of forecasting the economy; however, predicting the market’s movements in the short run often captures investors’ imagination. This behavior typically heightens hysteria, creating emotional responses which drive volatility. Keep in mind that stock prices are much more volatile than the business values that underpin them. In the long run, it is our belief that business values and stock prices converge.

With that in mind, we are viewing the bear market as an opportunity and using it to find wonderful businesses at bargain prices. With patience, we believe we will be rewarded when valuations normalize over the long term.

John Heinlein

Managing Director, Chief Investment Officer

The foregoing content reflects the opinions of Hunt Valley Wealth and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. Hunt Valley Wealth is a d/b/a of, and investment advisory services are offered through, Connectus Wealth, LLC, an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Connectus can be found at www.connectuswealth.com.

View your financial assumptions, goals and results of your financial independence analysis

View your financial assumptions, goals and results of your financial independence analysis

View the details of your HVW investment portfolios

View the details of your HVW investment portfolios

View your accounts custodied at Fidelity

View your accounts custodied at Fidelity