Fourth Quarter Market Review and Commentary

A strong fourth quarter capped off a tremendous year for U.S. equities. Near-term recession fears appear to have largely abated – while a “rotation to quality” helped propel seven magnificent companies to the top of 2023’s biggest winners list.

The U.S. inflation situation continues to improve, which has caused treasury market yields to move notably lower. The lower rates have been a reaction to the continued moderation in price growth and the expectation that the Federal Reserve is done raising rates. Even though the Fed continues to say that rates need to stay high for an extended period to effectively fight inflation, Wall Street thinks it will pivot in 2024 and begin cutting rates later this year. This, along with the belief that a “soft landing” for the economy is still plausible, has been a major contributor to the strong recent market performance.

By most counts, the U.S. economy has been doing very well. GDP growth was an exceptional 4.9% last quarter, unemployment remains near all-time lows, inflation has been heading lower, wage growth is outpacing inflation, and corporate profits are robust. This “goldilocks” scenario of moderating inflation in a still-expanding economy has emboldened equity investors, powering equities higher. However, it should be noted that this buying has pushed market valuations to elevated levels, which could leave stocks vulnerable to some profittaking on any disappointing news.

Market Review

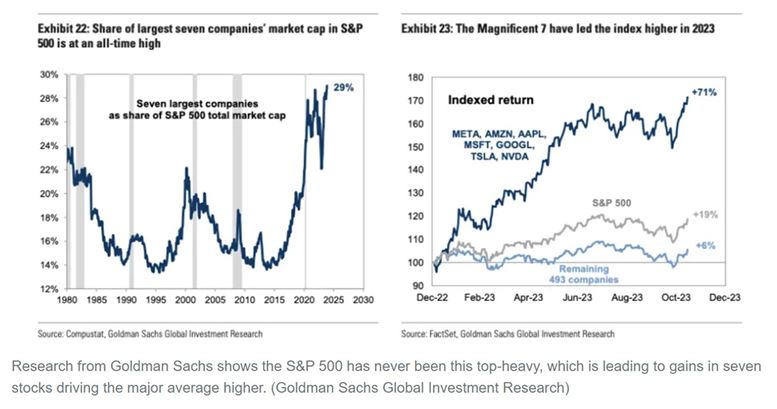

The markets closed out 2023 on a strong note. The benchmark S&P 500 was up 26.3% (including dividends), while the tech-heavy NASDAQ index finished up 44.7%. It’s important to note that the strong market performance comes after a nearly 20% decline for the S&P 500 in 2022, its worst annual performance since 2008. Although these indices showed strong gains in 2023, the advance was driven largely by a handful of stocks. Remember, these indices are market capweighted, meaning the larger the company, the more influence it has on the index’s return. In fact, the seven largest stocks by market cap accounted for nearly 75% of the S&P 500’s return. For the NASDAQ, the returns of only three stocks (Apple, Microsoft, and NVIDIA) were responsible for 30% of its gain.

What about 2024?

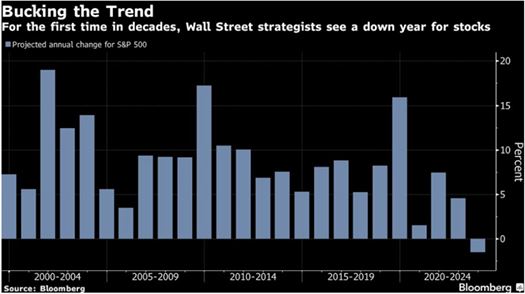

Looking at expectations for performance in 2024, while most investors seem optimistic, Wall Street strategists predict that the S&P 500 will have a down year, as shown in this recent Bloomberg chart.

We’ve spoken many times about the folly of trying to predict short-term movements in the market. Interestingly, most prognosticators were spectacularly wrong with their forecasts. At the end of 2022, The New York Times published an article titled “The Year the Long Stock Market Rally Ended” (LINK: SUBSCRIPTION REQUIRED), which demonstrates the recent track record of Wall Street’s market predictions. From the article:

“A year ago, bank analysts responsible for projecting where stocks would end 2022 were somewhat optimistic… Even the most pessimistic prediction at that time thought that the S&P 500 would finish the year 10% higher than where it actually will. Now, the most optimistic strategist doesn’t expect the S&P 500 to even make up that lost ground in 2023, while most expect the market to end roughly at where it’s starting, after a dip early in the year.”

As we can see, with the benefit of hindsight, the most pessimistic strategist wasn’t pessimistic enough in 2022, and the most optimistic strategist wasn’t optimistic enough in 2023. An extremely poor showing for the market “experts.”

We are not surprised at the results, as market prognosticators are almost always wrong. Unsurprisingly, we don’t believe market forecasts or timing needs to have any bearing on managing portfolios for long-term investors. As said before, these predictions do not affect how we invest for the long term. Trying to position portfolios based on forecasts introduces noise and additional decisions which are not only unnecessary but most often harmful to long term investment returns.

We manage portfolios using structural allocation between stocks, bonds, and cash, periodically rebalanced with alignment to one’s ability and/or willingness to bear risk. While this philosophy seems less sophisticated than moving in and out of the market based on macro factors, it is much less prone to large, unforced errors.

It is our belief that the most important factor in determining the long-term success of the portfolio is the performance of the underlying businesses. Of course, purchasing them at reasonable prices is equally important. We narrow our focus to the task of finding great businesses to own over the long run and purchasing at a discount to what we determine to be their intrinsic value. We will leave the market prognosticators to their fun while we stay focused on the task at hand.

The foregoing content reflects the opinions of Hunt Valley Wealth and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. Hunt Valley Wealth is a d/b/a of, and investment advisory services are offered through, Connectus Wealth, LLC, an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Connectus can be found at www.connectuswealth.com.

View your financial assumptions, goals and results of your financial independence analysis

View your financial assumptions, goals and results of your financial independence analysis

View the details of your HVW investment portfolios

View the details of your HVW investment portfolios

View your accounts custodied at Fidelity

View your accounts custodied at Fidelity