Forecasters Folly

Imagine a world where the future could be accurately foretold, where crystal balls dictated the trajectory of interest rates, economic landscapes, and stock markets.

There would be no need to work or save. We would all line up at the nearest soothsayer and have a clearly stated, actionable prediction of the future that we could benefit from. Everyone would win the lottery (though you’d have to share the winnings with everyone else who also won).

We would all buy Bitcoin at the bargain price of $0.00099 per coin when it launched and sell it when it peaked at $64,400 per coin (never mind that everyone else would do the same, so the speculative run-up in price would never actually happen).

It’s an appealing concept that has lured many seeking a shortcut to financial success. However, this siren song takes the shape of investors relying on expert forecasts from economists, market strategists, and media figures to predict the future accurately.

Historical data shows these forecasts are often inaccurate and can mislead investors – the crystal ball is often clouded, and predictions are more elusive than reliable.

The Illusion of Accuracy

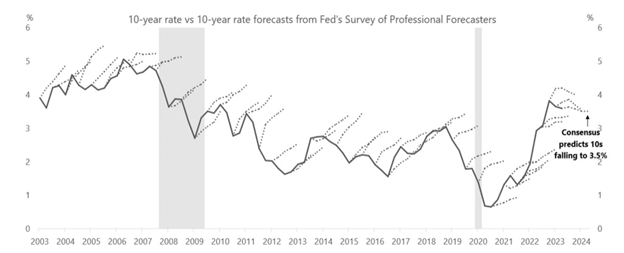

To fully appreciate the perils of putting blind faith in market forecasts, let’s look at a study that scrutinized the attempts of professional forecasters to predict future interest rates—a crucial metric shaping investment decisions—over 21 years.

The results revealed a consistent pattern of inaccuracy.

The dark line on the chart is the actual course of interest rates over time. The small dotted lines are actual forecasts that economists and other professional forecasters made.

As you can see, professional forecasters consistently found themselves on the wrong side of the prediction spectrum over this substantial period. Astonishingly, they erred in forecasting the direction of interest rates a staggering 80% of the time.

It raises a critical question: if those who make forecasting critical economic data their profession can’t reliably predict the future, why should the predictions of “market mavens” on the returns of specific investments or asset classes (which are built upon economic data like interest rates) be any more accurate?

A Shift in Perspective: From Predictions to Insights

Navigating the intricacies of the financial landscape calls for a compelling paradigm shift in how we approach investments. Instead of being captivated by the allure of predictions, successful investors are empowered by insights derived from the tangible performance of the companies in which they are invested.

The magic lies not in predicting the unpredictable but in understanding the present dynamics of the market. It’s a sentiment echoed by renowned investor Peter Lynch, who, drawing from his experiences managing the highly successful Fidelity Magellan Fund from 1977 to 1990, urges investors to dismiss the allure of forecasting.

“Nobody can predict interest rates, the future direction of the economy, or the stock market. Dismiss all such forecasts and concentrate on what’s actually happening to the companies in which you’ve invested.” – Peter Lynch

In embracing this shift, investors liberate themselves from the constraints of forecast dependency and position themselves as architects of their financial destinies.

By concentrating on the actual performance and fundamentals of the companies in one’s portfolio, investors gain a clearer understanding of the factors influencing their investments.

The journey from predictions to insights is not just a pragmatic choice; it’s a transformational step toward a future where investments are anchored in a deeper understanding of the companies that drive financial success.

At Hunt Valley Wealth, we champion this shift in perspective as a cornerstone of our investment philosophy. Rather than succumbing to the allure of predictions, our approach centers on providing clients with valuable insights into the companies they are invested in. We recognize that the key to successful investing is a nuanced understanding of the businesses driving the investments.

Forecasters Folly may be a tale of caution, but it’s also a story of empowerment—an invitation to step into a future where your investments are driven not by elusive predictions but by the tangible realities of the present.

Disclosures:

The information contained in this webinar is provided for informational purposes only, and should not be construed as investment advice or a recommendation to purchase or sell a security. Investing involves therisk of loss that clients must be prepared to bear. This document contains forward-looking statements of opinion, belief, and expectation about the future. Actual results could differ materially from such statements and our opinions are subject to change without notice.

View your financial assumptions, goals and results of your financial independence analysis

View your financial assumptions, goals and results of your financial independence analysis

View the details of your HVW investment portfolios

View the details of your HVW investment portfolios

View your accounts custodied at Fidelity

View your accounts custodied at Fidelity