First Quarter Market Review and Commentary

Stocks rebounded sharply from December lows, but we don’t appear to be out of the woods just yet.

The S&P 500 index rose roughly 6%, while the NASDAQ advanced 10.72% in January to start the year. Over the next two months of the quarter, the S&P added another 1% while the NASDAQ tacked on another 6%. In summary, the S&P finished up 7% while the NASDAQ surged 17% for the quarter.

It seems that the rapid rate increases by the Fed over the past year are starting to show its effects on the economy. Inflation, while still elevated, appears to be waning. The February Employment Report showed that the upward pressure on wages might be easing. Housing and manufacturing are showing some weakness, and consumers are beginning to exhibit some hesitation to spend on certain items. Despite the progress, inflation is still above the Fed’s 2% target, and it’s still unclear if that goal can be achieved without risking a recession or systemic problems.

One such systemic disruption has shown up in the banking sector. During the month of March, two large regional banks failed; Silicon Valley Bank and Signature Bank. For a detailed explanation, see our letter that was sent out on March 16 (link). To simplify what happened, the banks invested in longer-term bonds that they could not readily convert to sufficient cash to meet large withdrawals from depositors. These events prompted the federal government to step in and protect deposits. Talks of a possible contagion still linger.

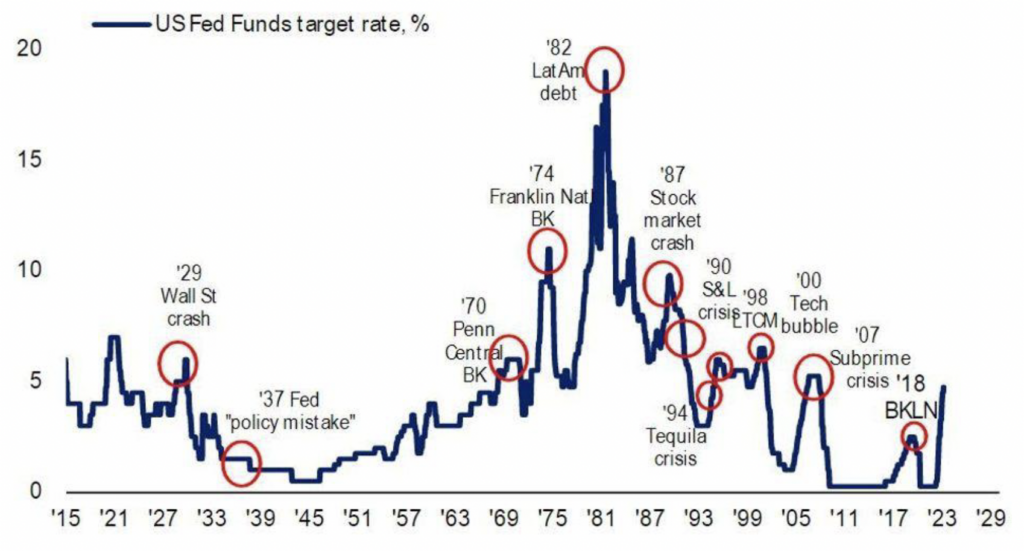

While the causes of bank failures are complex, Fed policy clearly played a role. Federal Reserve policymakers are walking a tightrope in a battle to tame prices. It remains to be seen if they will be able to do so without unintended consequences of a recession or other potential systemic problems. History has shown that periods of Fed monetary tightening have a strong tendency to “break something,” as shown in the chart below from BofA Global Investment Strategists.

Fed tightening always “breaks” something

US Fed Funds target rate

Source: BofA Global Investment Strategy, GFD Finaeon, Bloomberg.

Looking ahead, it would stand to reason that the stress on the banking industry could make it difficult for them to provide loans to the private sector. Faced with perceived business risks, banks will seek to hold their capital more tightly. This would slow economic activity, which would help the Fed in its efforts to bring down the inflation rate.

Turning the attention to individual companies, the near-term earnings outlook appears uninspiring. Many companies are reducing staff as defending margins seems more important than business expansion. Facing an economic slowdown and having businesses pull back on growth may seem dire, but there could be some good news. We may be nearing the end of the Fed rate hike cycle. If that’s the case, and history is a guide, stocks have performed well after the last Fed rate hike.

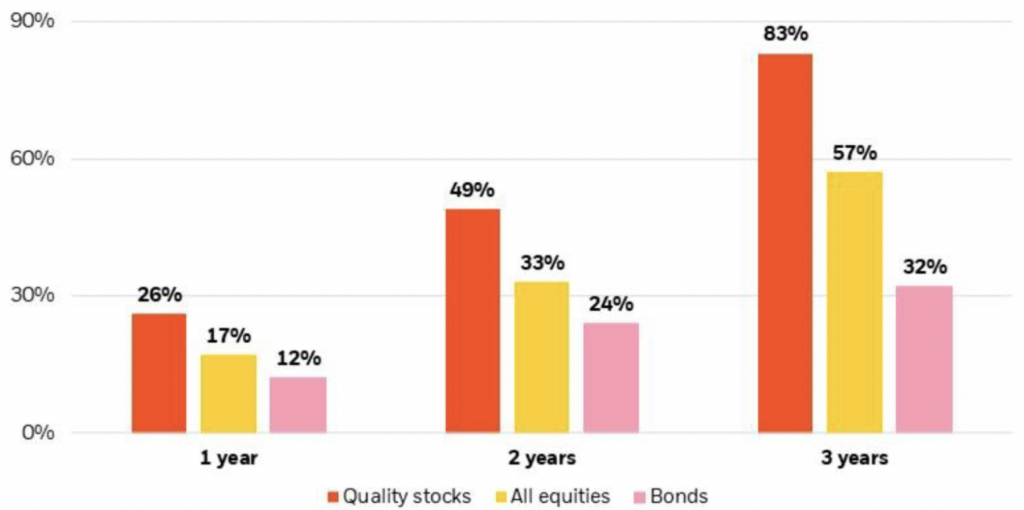

The chart below, produced by BlackRock, shows the returns of Quality Stocks, All Equities, and Bonds after the Fed stopped raising rates from 1984 – 2021. The chart suggests that while all three asset classes performed well, “quality stocks” have outperformed. Their definition of a “quality stock” is proprietary, but you can get the idea.

Quality readying to lead?

Average returns after Fed hiking cycle ends, 1984-2021

Source: BlackRock Fundamental Equities, with data from the Board of Governors of the Federal Reserve System and Bloomberg, calculated from August 31, 1984-Dec. 31, 2021. Returns are calculated from the month when the Fed stops raising rates for peak rates periods in 1984, 1989, 1995, 2000, 2006 and 2018. All equities represented by the Russell 1000 Index and bonds by the Bloomberg U.S. Aggregate Index. “Quality” is defined as the top quintile of stocks ranked in the Russell 1000 Index using a proprietary research screen that assesses companies on 13 “quality” metrics. Past performance is not indicative of current or future results. Indexes are unmanaged. It is not possible to invest directly in an index.

When investing in stocks, it’s important to remember that there will always be something to worry about. Nobody can predict interest rates or the future direction of the economy, and we are no exception. While the stock market can seem like a yo-yo at times, it’s important to remember that businesses are not.

In spite of the uncertainty in the markets and economy, we continue to focus our attention on what’s actually happening to the companies that we own or look to own in the future. If we should encounter a period of volatile market prices, we hope to take advantage of it.

“We own publicly traded stocks based on our expectations about their long-term business performance, not because we view them as vehicles for adroit purchases and sales. That point is crucial: Charlie and I are not stock pickers; we are business pickers.”

Warren Buffett

John Heinlein

Managing Director, Chief Investment Officer

The foregoing content reflects the opinions of Hunt Valley Wealth and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. Hunt Valley Wealth is a d/b/a of, and investment advisory services are offered through, Connectus Wealth, LLC, an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Connectus can be found at www.connectuswealth.com.

View your financial assumptions, goals and results of your financial independence analysis

View your financial assumptions, goals and results of your financial independence analysis

View the details of your HVW investment portfolios

View the details of your HVW investment portfolios

View your accounts custodied at Fidelity

View your accounts custodied at Fidelity