Exploring the Benefits of Fundamental Investing

Successful investing is much like taking a long journey across an ever-evolving landscape. It’s crucial to have guiding principles, formed by time and experience, to propel you to your destination while acting as guardrails to keep you from getting lost in a swampy morass or careening off a rocky cliff.

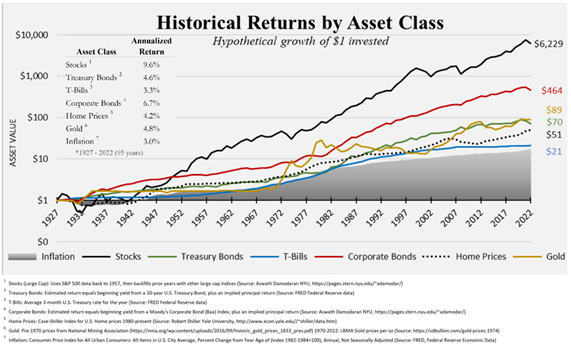

For this journey, history has a lot to teach us. By studying the past performance of various asset classes, you gain insights into what has consistently worked over the long term. The goal isn’t predicting the future but learning from past patterns.

The chart above is the hypothetical growth of a dollar invested in various assets over time. As you can see, stocks have consistently outperformed other asset classes, such as bonds or real estate.

Stock outperformance isn’t just a random occurrence; it’s rooted in the dynamics of capitalism. When you own a share of a company, you’re not just a passive holder of an asset; you’re a stakeholder in a profit-generating entity. This ownership grants you a share of the company’s success, allowing you to receive cash flows from the business’s operations.

Stocks stand out as superior to other asset classes in their growth over time, thanks mainly to the strategic reinvestment of the cash flows they generate.

Like a snowball rolling downhill, gaining size and momentum, reinvesting cash flows allows you to grow your investment exponentially as you benefit from the compounding effect. This effect amplifies your returns over time and makes stocks a compelling option for long-term investors.

Not all companies are equally successful, and not all stocks make great investments. How do you select the right stocks to invest in over time?

Fundamental investing is a method of selecting stocks for long-term investments. It is based on analyzing a company’s financials and other data to determine the stock’s intrinsic value and potential to grow cash flows over time.

This process involves a blend of quantitative and qualitative research to create a holistic view of the companies with the ability to generate high rates of return on reinvestments and the strength to weather economic storms and emerge stronger.

In the world of investing, adaptability is critical. A fundamental investor doesn’t just set and forget; they continuously test and refine their strategy to align with evolving market conditions.

Fundamental investing encourages a balanced approach—adapting to change without compromising the core principles that make your strategy effective. It requires a non-stop iterative process, patience, and a long-term view to see things through to their successful conclusion.

Investments should be aligned with your time horizon to maximize the potential returns from a stock portfolio. For many investors, long-term personal and financial goals set the investment horizon years into the future, so it is vital to have a long-term mindset and ignore the market’s short-term noise and gyrations.

In a world dominated by instant updates and short-term thinking, embracing such a long-term mindset and aligning your strategy with historically sound methods – such as fundamental investing – can set you apart as a savvy investor.

The journey ahead may have its challenges, but armed with a long-term perspective, a keen eye for fundamental value, and the ability to tune out market noise, you have the tools to navigate the terrain with confidence.

Of course, you are not on this journey alone. Our seasoned team is ready to act as guides and sherpas to help you navigate the path and arrive at your destination on time and in good shape.

Disclosures:

The information contained in this webinar is provided for informational purposes only, and should not be construed as investment advice or a recommendation to purchase or sell a security. Investing involves the risk of loss that clients must be prepared to bear. This document contains forward-looking statements of opinion, belief, and expectation about the future. Actual results could differ materially from such statements and our opinions are subject to change without notice.

View your financial assumptions, goals and results of your financial independence analysis

View your financial assumptions, goals and results of your financial independence analysis

View the details of your HVW investment portfolios

View the details of your HVW investment portfolios

View your accounts custodied at Fidelity

View your accounts custodied at Fidelity